The importance of cross-connectivity among various blockchain networks is growing rapidly in the decentralized finance (DeFi) landscape.

Users wish to encompass numerous financial services across several ecosystems, making interoperability essential. This need is met by cross-chain bridges, such as Jumper Exchange, which form connections between distinct blockchain networks that would otherwise be detached.

DeFi, or decentralized finance, has revolutionized the way people interact with financial services, offering a more open and accessible alternative to traditional banking systems. As the DeFi ecosystem continues to expand across multiple blockchain networks, the need for seamless interoperability becomes increasingly crucial. Cross-chain bridges play a pivotal role in this regard, enabling users to leverage the unique advantages of different DeFi protocols and platforms without being confined to a single blockchain. By facilitating the free flow of assets and data between networks, these bridges are instrumental in realizing the full potential of DeFi, creating a more interconnected and efficient financial landscape for users worldwide.

These bridges allow for smooth transfers of assets and data, streamlining the user experience. Moreover, they serve as pivotal tools in extending the reach of DeFi to a wider user base, by simplifying and decreasing the cost associated with using multiple blockchain systems.

Jumper Exchange is a top-tier bridge aggregator that connects users with multiple blockchain bridges, offering seamless cross-chain swaps. Jumper is focused on creating a user-friendly experience with an intuitive interface and robust backend infrastructure.

Why Cross-Chain Bridges Are Essential For Defi

The DeFi ecosystem is based on a variety of blockchain networks, with each network providing distinct strengths, applications and user communities.

These networks typically behave as detached territories with scarce intercommunication. To mitigate this constraint, cross-chain bridges imbue free circulation of assets, tokens, and data amid networks.

For instance, should a user possess an asset on Ethereum wishing to engage in a DeFi protocol on Binance Smart Chain (BSC), a cross-chain bridge furnishes them the option to reshuffle their assets without selling or swapping astray via centralized exchange.

On the platform of Jumper Exchange, users reap advantages of a user-friendly platform measured for expediting these transfers. It gives them room to explore opportunities on numerous networks, dodging large fees and extensive procedures frequently associated with cross-chain movements.

The spike in accessibility becomes increasingly crucial with DeFi’s quantitative growth, offering users an enhanced spectrum for trading, borrowing, and more.

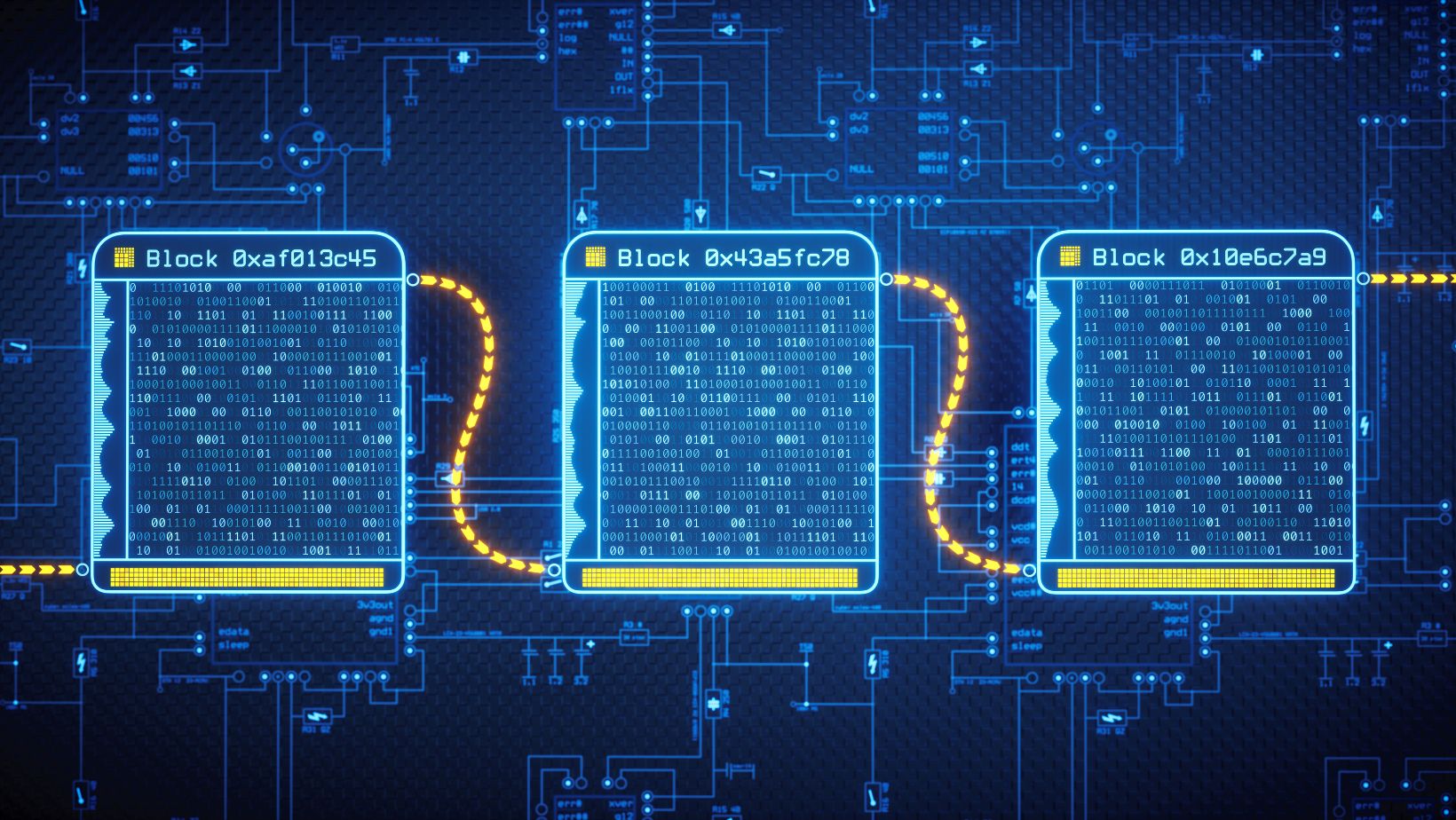

How Cross-Chain Bridges Work

The operational mechanism of cross-chain bridges involves securing assets on one blockchain while producing matching tokens on an alternate path.

For example, if you move a token from Ethereum to another network via a bridge, it usually retains the primary token in a smart contract and dispenses a corresponding “wrapped” token on the intended blockchain.

When consumers want to restore their resources to the initial chain, the bridge “unlocks” the original token by eliminating or reimbursing the wrapped asset, thus maintaining balance in total supply across chains.

The Jumper Exchange minimizes the intricacies of this process for users by suplying an intuitive interface that diminishes the requirement for intricate understanding about innate technical details. This methodology enables both expert DeFi participants as well as rookies to seamlessly utilize DeFi services on numerous chains.

Benefits Of Cross-Chain Bridges In DeFi

The 4 main benefits of cross-chain bridges are the following.

Improved Liquidity

Through the facilitation of unrestricted asset transitions among chains, a rise in DeFi market liquidity is realized courtesy of cross-chain bridges.

Greater access to an expanded array of trading pairs and decentralized exchanges is an evident outcome.

Cost Savings

Substantial shifts in gas fees are typical across various blockchains – an aspect that cross-chain bridges utilize to provide users with the cost efficiencies of contrasting networks. To illustrate, should Ethereum’s gas fees escalate, a conscientious user may consider the relocation of assets towards a network boasting lower fees thereby ensuring optimal cost-savings in transaction procedures.

Enhanced User Experience

Cross-chain bridges, particularly user-friendly ones like Jumper Exchange, make DeFi services more accessible to a wider range of users by removing the need for multiple wallet setups and reducing complex transaction steps.

Broader Access to DeFi Protocols

Many DeFi protocols are chain-specific, meaning users are restricted to the ecosystem they are on. With cross-chain bridges, users can participate in protocols across different chains without needing to convert assets or switch platforms.