CFOs are under pressure like never before. Rising costs, tighter cash flow, and the pressure to do more with less – all this is forcing finance leaders to rethink how their teams operate.

And one area that’s getting the most serious attention? Accounts payable.

For years, AP was the department that people just put up with, slow, manual, and full of repetitive tasks. But in 2025: Not anymore. CFOs are treating accounts payable automation as a strategic investment, not a nice-to-have. Why? Because the ROI is undeniable. You get faster processing, lower costs, clearer visibility, and fewer errors.

Let’s understand these reasons in detail.

Reasons Why Accounts Payable Automation Software Is A Must In 2025

As financial operations evolve, automating accounts payable is crucial in 2025 for efficiency, accuracy, cost savings, and smarter business decisions.

Manual AP is draining your budget and slowing your business

What most CFOs overlooked back then is how expensive and slow manual accounts payable processing can be. According to the latest research, the average cost to process a single invoice manually ranges from $15 to $40. For enterprises processing thousands of invoices monthly, that translates to millions of dollars spent on data entry, approvals, and reconciliation.

But cost is not the only problem. Manual processing drains your time, too. An invoice approval cycle typically takes 14.6 days when done manually. Such delays cause real problems:

- You lose early payment discounts: Vendors offer a 2–3% discount for quick payments, but slow approvals wipe out those savings.

- You strain vendor relationships: Late payments make partners lose trust and push for stricter terms. This also affects your business liquidity status.

- You block growth: An overloaded AP team slows down new vendors, expansions, and acquisitions.

Cash flow visibility becomes a competitive advantage

Cash is king, especially in today’s uncertain economic times. If CFOs don’t have a clear idea of what they owe, when payments are due, and how much cash they have, how can they compete and make strategic decisions? Automation changes the game.

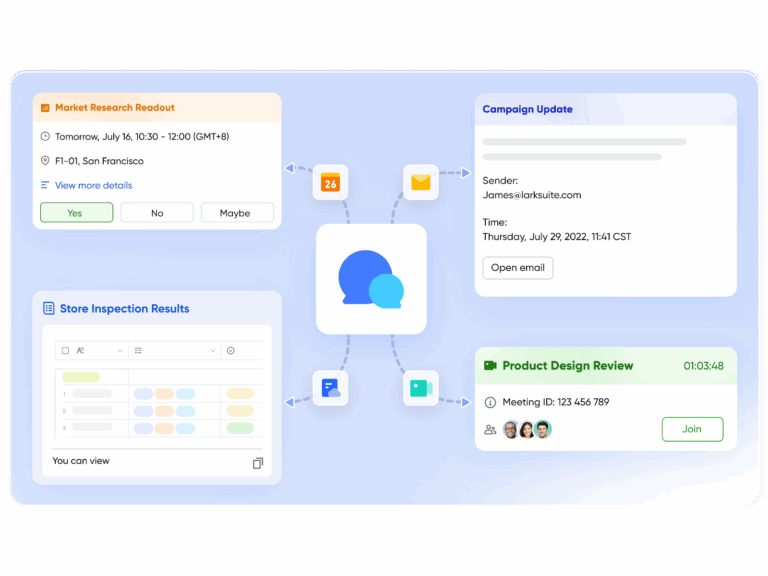

Accounts payable automation software provides CFOs with dashboards that display outstanding invoices, upcoming payment obligations, and real-time cash flow projections. This visibility enables smarter decisions:

- Dynamic discounting: When you know your cash position, you can decide which invoices to pay early for discounts and which to stretch to preserve working capital.

- Better forecasting: Accurate AP data feeds into cash flow models, improving forecasting accuracy and reducing surprises.

- Strategic payment timing: Instead of rushing to pay everything or letting invoices pile up, you optimize payment timings based on your cash flow.

Automation bridges the AP talent crunch

The job market is messed up. Finding and retaining skilled AP professionals is becoming increasingly challenging.

Baby boomers are retiring, millennials are already moving to strategic roles, and younger professionals (GenZs) aren’t rushing to fill AP roles that involve tedious data entry. As a result, finding and keeping skilled AP professionals is harder.

Automation solves this in two ways:

- It fills the talent gap: Automated systems handle invoice capture, data extraction, matching, and approvals without human intervention. You need fewer people to process the same volume.

- It makes AP roles more appealing: With less grunt work, your AP team can focus on value-driven work like vendor negotiations, process optimization, etc. That makes roles more engaging and easier to fill.

AP Software delivers Measurable ROI in Months, not Years

CFOs live and die by ROI. Every dollar spent needs to justify itself fast.

That’s why automation stands out; it pays back quickly. By using the AP automation software, most organizations see full ROI within 6-12 months. The savings come in the form of:

- Time savings – Invoices that took 15-20 minutes to process manually now take seconds.

- Fewer late fees – Faster approvals mean fewer missed deadlines.

- Reduced manual labor – When all work, like data sourcing, invoice capturing, and extraction, is done on AP software, then your team is free to focus on analysis and forecasting.

- Fewer errors – Machines make negligible mistakes compared to humans.

- Lower processing costs – Automation cuts per-invoice costs by approximately 50 to 80%, driving real savings across large invoice volumes.

For CFOs under pressure to justify every dollar spent, that timeline is compelling.

Wrapping Up

CFOs can no longer afford to treat AP automation as optional. Sticking with manual processes means higher costs, more errors, strained vendor relationships, and missed opportunities. Automation isn’t just about efficiency; it’s about giving finance teams the clarity, speed, and control they need to make smarter decisions.

By adopting AP automation now, organizations free their teams from repetitive work, improve cash flow management, and prepare for growth. In 2025, acting on AP automation is a necessary step for any business that wants to stay competitive and future-ready.