Stock valuation refers to the process of determining the worth of a company’s stock in the market. Investors use various methods such as the discounted cash flow (DCF) model, the price-to-earnings (P/E) ratio, and other analytical tools to determine the value of a stock. However, these methods are not only influenced by internal company factors like revenue, profits, and assets but also by global trends.

Global trends refer to the overarching forces that impact the financial markets worldwide, such as economic growth, geopolitical events, technological advancements, and changes in consumer behavior. These trends can have either short-term or long-term effects on stock prices, making it essential for investors to stay informed and adapt their strategies accordingly.

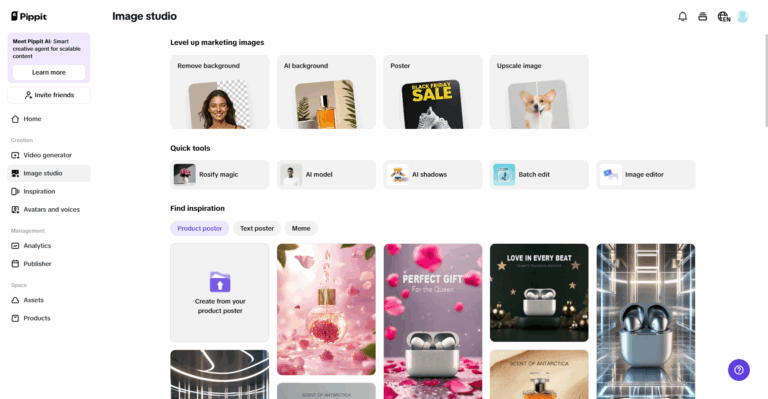

Alphaspread is an excellent platform that helps investors navigate the complexities of stock valuation by providing in-depth financial data and tools. By leveraging such resources, investors can make more accurate assessments of how global trends might influence stock valuation outcomes.

Global Economic Trends and Stock Valuation

The global economy serves as the foundational backdrop for all market activities. Economic trends such as inflation rates, interest rates, GDP growth, and global trade patterns heavily influence stock valuations. A robust global economy generally promotes corporate growth and stability, which reflects positively in stock prices. Conversely, economic downturns or recessions can have the opposite effect, leading to declines in stock valuations.

- Inflation and Interest Rates

Inflation directly impacts the purchasing power of consumers, which can lead to reduced corporate earnings. Central banks around the world, including the Federal Reserve in the United States, adjust interest rates to manage inflation. When interest rates rise, borrowing costs increase, which can lead to a decrease in corporate investments and, consequently, lower stock prices. On the other hand, lower interest rates often make borrowing cheaper, encouraging businesses to invest and grow, which can raise stock prices.

- Global Trade and Supply Chains

Global trade is an important determinant of stock valuation, especially for multinational companies. Changes in trade policies, tariffs, or geopolitical tensions can disrupt supply chains and cost structures, ultimately affecting profitability. For example, the trade war between the U.S. and China significantly impacted the valuation of companies that rely on Chinese manufacturing and exports.

- GDP Growth

Gross Domestic Product (GDP) growth is another key indicator of economic health. A growing global economy often translates into higher demand for goods and services, which leads to increased corporate earnings and improved stock valuations. Conversely, stagnating or contracting GDP can signal weaker demand and earnings, leading to declines in stock valuations.

Political Trends and Stock Valuation

Political trends play a pivotal role in shaping market sentiment. Policies implemented by governments—whether fiscal, monetary, or regulatory—can create an environment that fosters economic growth or one that stifles it. Political instability, changes in leadership, and significant policy changes can also cause significant shifts in stock valuations.

- Government Regulations and Tax Policies

Government regulation and taxation policies directly affect a company’s operations and profitability. For instance, corporate tax cuts can lead to increased earnings, boosting stock valuations, while higher taxes or stricter regulations can reduce profitability and harm stock prices. Political discussions surrounding topics like climate change, data privacy, or labor laws can also significantly impact certain sectors, especially technology, energy, and manufacturing.

- Geopolitical Risks

Geopolitical risks, including military conflicts or shifts in diplomatic relations, can create uncertainty in global markets. Companies operating in conflict zones or regions with unstable political environments are likely to face reduced stock valuations due to perceived risks associated with operations in those areas.

For example, the Russia-Ukraine war created disruptions in the global energy markets, impacting the stock valuations of companies in the energy and defense sectors.

- Government Stimulus Measures

During economic downturns, governments often implement stimulus measures to bolster the economy. These measures can include direct financial aid to citizens, subsidies for businesses, or stimulus checks aimed at boosting consumer spending. While these actions can provide a temporary boost to economic activity, they can also contribute to inflationary pressures, which can influence the long-term trajectory of stock valuations.

Using Platforms like Alphaspread for Trend Analysis

Investors today have access to a wealth of data to help them navigate these global trends and assess their impact on stock valuations. One such platform that can assist investors in tracking trends and making informed investment decisions is alphaspread.com. This platform provides detailed financial analytics, trend analysis, and valuation metrics for stocks across various sectors. By using such resources, investors can better understand the underlying factors driving stock prices and identify investment opportunities that align with long-term global trends.

On Alphaspread, users can analyze companies’ performance against global benchmarks, monitor economic indicators, and stay updated on the latest geopolitical and technological shifts. Whether tracking inflation rates, exploring the latest technological innovations, or monitoring government policies, Alphaspread serves as a vital tool in the arsenal of any investor who wishes to remain informed and make strategic investment decisions.

Technological Trends and Stock Valuation

Technological innovations are rapidly transforming industries and have a profound impact on stock valuations. Companies that adopt new technologies or develop groundbreaking innovations often see their stock valuations soar, as investors anticipate significant long-term growth. Conversely, companies that fail to keep up with technological advancements risk becoming obsolete, leading to a decline in stock value.

- Automation and Artificial Intelligence

The rise of automation and artificial intelligence (AI) is changing the competitive landscape for many industries. Companies that integrate AI and automation into their operations can reduce costs and improve efficiency, boosting profitability. Investors closely watch these advancements, and stocks of companies leading in AI adoption tend to see positive valuation outcomes. However, industries that are slow to adopt these technologies may face challenges that reduce their stock valuations.

- Tech Sector Growth and Innovation

The tech sector is a prime example of how technological trends influence stock valuations. Companies in sectors like software development, cloud computing, and biotechnology are valued not only based on current earnings but also on their potential for future growth driven by technological advancements. Tech companies like Tesla, Amazon, and Apple have seen substantial growth due to their continuous innovation and the integration of emerging technologies into their products and services.

- Cybersecurity

As digital transformation accelerates, cybersecurity has become a critical concern for companies and governments alike. The rise in cyberattacks and data breaches has led to increased investments in cybersecurity technologies, boosting the stock valuations of companies in this sector. Investors recognize the growing importance of cybersecurity, and stocks of firms providing security solutions often experience valuation boosts in response to rising threats.

Environmental and Social Trends

In recent years, environmental, social, and governance (ESG) trends have gained significant traction. More investors are now considering ESG factors when making investment decisions, and companies that prioritize sustainability and ethical governance practices are often rewarded with higher stock valuations.

- Sustainability and Corporate Social Responsibility

Companies that demonstrate a commitment to environmental sustainability are increasingly viewed favorably by investors. Businesses that invest in renewable energy, reduce carbon footprints, and engage in sustainable practices are gaining attention from a growing pool of socially conscious investors. This trend has led to the rise of green bonds and eco-friendly investment funds, which focus on supporting companies with strong environmental records.

- Social Responsibility

Social responsibility initiatives, such as fair labor practices, diversity and inclusion efforts, and philanthropic endeavors, can also influence stock valuations.

Investors are increasingly evaluating companies based on their social impact and reputation. Companies that are seen as ethical and socially responsible are more likely to retain loyal customers and employees, leading to stronger financial performance and higher stock valuations.

- Climate Change and Regulatory Compliance

Climate change has become a dominant global issue, and governments are enacting regulations to reduce greenhouse gas emissions and promote sustainable practices. Companies that are proactive in adapting to these changes and meeting regulatory requirements may experience stock valuation increases, while those that fail to comply may face fines and reputational damage, leading to lower valuations.

Conclusion

In conclusion, global trends significantly influence stock valuation outcomes, and investors must stay informed about these developments to make sound financial decisions. Economic factors, political shifts, technological advancements, and environmental and social trends all play critical roles in determining how stocks are valued in the market. By leveraging platforms like Alphaspread, investors can gain valuable insights into how these trends impact individual companies and the broader market, ultimately leading to more informed investment strategies. Understanding these global trends is key to unlocking the potential for long-term success in the stock market.